Article by BuyBizSell

I remember calling my dad the day after September 11th in 2001 and telling him I had closed our offices for the day in honor of the 9/11 victims and first responders. His response is very much still etched in my memory. My dad said, “Why? You’re letting them win!”

COVID-19 is our enemy and we cannot let it win.

The SBA, as part of the CARES Act signed by the President on March 27th, is paying six months of SBA loan payments (principal plus interest) for all current SBA loans and new SBA loans closed before September 27, 2020. This is not a payment deferment but, rather, the SBA will pay the first six months of loan principal, interests and associated loan costs to the lender. As an example, this is a $33,300 forgiveness on a $500,000 loan at the current interest rate of 6%.

In order to close an SBA loan before September 27th, here are some dates to use as guidance:

Begin looking today for your new small business. Work with the seller and the seller’s broker to have a firm offer in place so that you can complete due diligence in June and have an offer, LOI or draft purchase agreement, in place by July 1st.

Once you have an offer in place, the BizBuySell Finance Center can help connect you to the best lender for your project.

If you are able to have the business and the financing in place by July or August, you should have more than enough time to successfully complete your purchase.

A typical SBA business acquisition loan will take between 45 and 90 days from lender Term Sheet to loan closing.

Six months of loan payments being made by the SBA is a significant incentive for a prospective business buyer to buy a business.

Here is a brief remark made by the President as he signed the bill,

“I want to thank Republicans and Democrats for coming together, setting aside their differences, and putting America first.

This legislation provides for direct payments to individuals and unprecedented support to small businesses. We’re going to keep our small businesses strong and our big businesses strong. And that’s keeping our country strong and our jobs strong.”

Your government is united in helping Small Business stay strong.

There will be many owners of businesses who were “on the fence” about whether or not to sell their business prior to the pandemic decide it is time for them to retire and turn the reigns of their business over to a new owner rather than work through the changes that will surely come post COVID-19. Now may be the perfect time for a new owner to come in and make the necessary technology, marketing, or process changes to maintain and expand the business.

The recent BizBuySell Insight Report highlighted a few of these forthcoming business model changes which can be easily implemented by a fresh new buyer. Such as:

- Restaurants — Strengthen the delivery and carry-out business. Update the menu for more “portable” meals. Add outdoor seating and make adjustments for more economic indoor seating.

- Retail Stores — Now is the perfect time to launch a brand new website to take online orders or maybe accept orders from Amazon.

- Manufacturing — Take advantage of the forthcoming increase in orders as US corporations shore up a more local supply chain from offshore to onshore.

Did you know most SBA business acquisition loans provide working capital for just such improvements?

The CARES Act benefit for a $450,000 SBA loan adds up to $30,000. This is an additional $5,000 per month during the first 6 months of new ownership directly added to your monthly cash flow.

The SBA will begin making your loan payments (principal + interest) starting from day one. What better time to have such an incentive as during the time you are transitioning into your new ownership role?

To be eligible to receive an SBA loan with these benefits, you’ll need to have at least $70,000 cash available to qualify. This incentive from the SBA does not mean banks will underwrite with this additional cash flow in mind. The lender will take into consideration the short-term cash flow impact of COVID-19 but the business must be performing reasonably well during and post-pandemic.

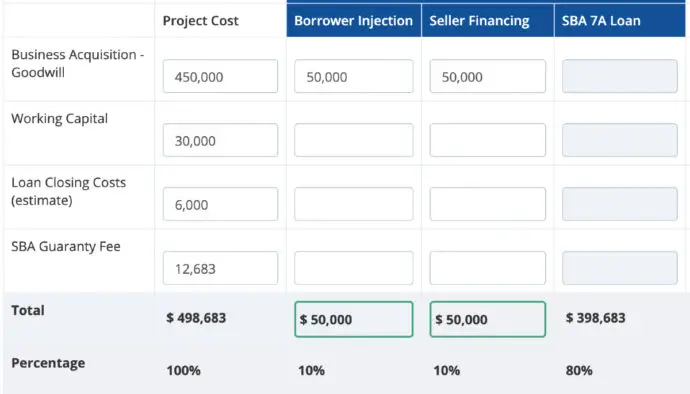

Here is an example of an actual financing structure for the acquisition of a $450,000 online business recently listed on BizBuySell:

The buyer should plan on having at least $70,000 in liquid assets. The $50,000 down payment must not leave the buyer with zero cash post-closing. This is not the time for a buyer with a weak personal financial position to buy a business.

Notice the lender has added $30,000 working capital in addition to the estimated closing costs and SBA loan guaranty fee. The SBA loan guaranty is what funds the SBA 7a loan program.

An optional seller note, or seller financing, assures the seller has some “skin in the game” to help with a smooth ownership transition. The seller note is not required but most lenders look for an LTV, or loan-to-value, of not more than 80%. If there is no seller note, the SBA loan would be for about $450,000.

The CARES Act incentive of the six months of SBA loan payments is $30,000, or $5,000 per month. So, the initial down payment of $50,000 minus the incentive of $30,000 means the effective down payment for your new business is just $20,000 after six months of new ownership. Assuming the owner benefit, or SDE, is at least $40,000 per year, you have just purchased a new business for $0 net cash outlay in the first 6 months.

In summary, the CARES Act can help you buy a new business with effectively no money out of pocket. To learn more how this can apply to your business acquisition, complete the form in the BizBuySell Finance Center.