By Taryn Sauer

THE GOOD

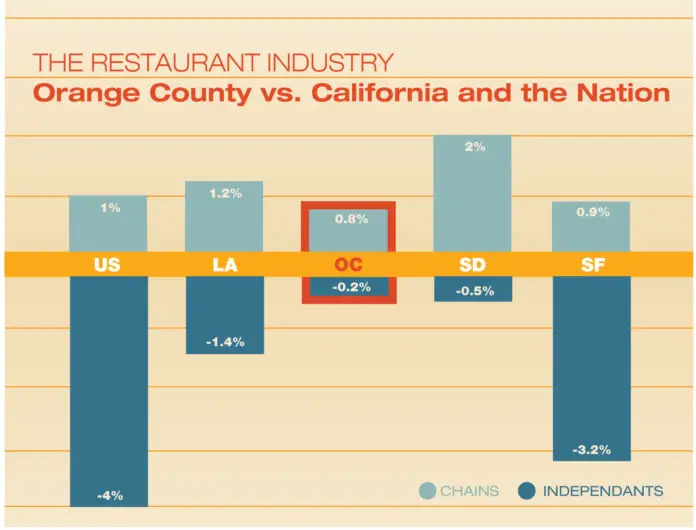

According to the Natural Purchase Diary (NPD) Group, while national restaurant numbers dipped by nearly 10,000 units (-2 percent) in 2016, the Orange County Restaurant Industry remained solid.

Despite the national decrease, OC restaurants lightly increased with the main component of

growth stemming from chain restaurants, which grew by 17 units in 2016 (.5 restaurants per each of OC’s 34 cities).

Even in comparison within the California market, OC restaurants fare better. Neighboring cities like Los Angeles saw a .1 percent decrease in numbers overall; San Diego restaurants decreased by .2 percent; and the San Francisco – Oakland area fell with the largest drop at a 1.6 percent decrease.

Why has Orange County remained solid? According to Jot Condie, President & CEO of the

California Restaurant Association, the OC economy plays a large part. Coastal OC restaurants benefit from a tourist-supported economy and Orange County residents, as a whole, tend to be more affluent, allowing for a healthy amount of dining out.

THE BAD

“However, beneath these solid location numbers lies a more troubling trend,” Condie said. “The average profit margin in the restaurant industry is 3-5 percent, so there is very little room for error. As cost pressures continue to mount (a looming $15 minimum wage, increased rents, insurance premium increases, etc.) the industry is struggling with a

business model that is not sustainable.”

In response to such pressures, some restaurants are shifting toward a plan that affects the FOH most. Less labor equals less expenses and more restaurants are adopting counter service over table service. Even still, while QSRs continued to expand, traffic was flat last year, according to the NPD.

Independent restaurants suffered the most, with a four percent decrease, nationally; and by 13 units in Orange County. For most independent restaurants in the full-service business, keeping up with increasing costs is even more difficult because mom and pop shops often do not have access to capital in the way that corporate and chain restaurants do. That added with the decrease in traffic by 2 percent makes staying afloat an upstream battle.

“This is the most significant drop in total U.S. restaurant counts since the recession,” says Greg Starzynski, Director of Product Management for NPD Foodservice. “If consumers continue to reduce their restaurant visits, we expect the number and density of restaurant units will continue to decline in response to the lower demand.”

THE ORANGE

The NRA anticipates that restaurant industry sales will reach $799 billion by the end of 2017 and California will contribute $82.2 billion to that revenue.

The NPD expects the U.S. restaurant industry traffic will remain stalled in 2017 in much the same manner it did in 2016. QSRs, which represent 80 percent of total industry traffic, will increase visits by an estimated 1 percent, faring better than the flat growth achieved in 2016. The modest gain for QSRs will offset the anticipated 2 percent decline for fullservice restaurants, resulting in no-growth traffic for the industry overall.

Although the forecast looks glib, Condie reminds us of the Orange County Restaurant Industry’s contribution to the nation.

“Some of the most notable growing restaurant concepts are born in Southern California, specifically OC,” he said.

Slapfish, Bruxie and Slater’s 50/50, among others, continue to expand locally and across the U.S.

AN EXPERT’S OUTLOOK

JOT CONDIE

JOT CONDIE

PRESIDENT & CEO CALIFORNIA RESTAURANT ASSOCIATION

WHAT DO YOU ATTRIBUTE TO THE ORANGE COUNTY RESTAURANT INDUSTRY REMAINING SOLID IN NUMBERS (LOCATIONS), WHILE NATIONAL NUMBERS HAVE DECREASED? OC, like many coastal regions in California, enjoys a healthy tourism-supported economy. The region also has a relatively affluent population compared to the nation. Restaurant traffic appears to be healthier in Orange County than in many other parts of the state where the economy is less robust.

IS THE STATE OF THE INDUSTRY ANY DIFFERENT FOR OTHER PARTS OF CALIFORNIA AND IF SO, WHY? Depending on the region, the state of the industry varies. In the Bay Area, restaurants are struggling. In San Francisco, restaurant owners are feeling the weight of many years of elected officials piling on mandate after mandate taking the profitability out of owning a restaurant. In Palo Alto, which has a healthy economy, even very popular, long-established restaurants are struggling to stay open because the city’s elected officials accelerated the phase-in of a $15 minimum wage. This is exacerbated by the fact that most of the tech campuses have large foodservice operations where the workforce eats

for free and therefore, dine out less often. Add to that the fact that these tech cafeterias are luring needed cooks away from restaurants, who simply can’t afford to pay as much as tech pays. The increased regionalism that dictates the state of the industry is largely driven by local governments creating their own employment laws that make the restaurant operating environment different – city by city.

IS THE STATE OF THE INDUSTRY ANY DIFFERENT FOR LARGE VS. SMALL BUSINESS? Generally, small independent restaurants do struggle more to survive. Often, family-owned and run restaurants do not have the access to capital. Many of the larger or emerging restaurant brands have access to investors (private equity or VC funds). And it is these investors who are fueling much of the growth of the emerging restaurant brands.

WHY ARE CHAINS GROWING AND NOT INDEPENDENT? The chain restaurant category is being boosted somewhat by the growth in fast-casual restaurants, places like MOD Pizza and Pieology. One city, Sacramento, has actually seen its number of independent

restaurants grow, but that is in large part because of the focus on locally-owned businesses around the new Golden 1 Center. Unfortunately, what we’ve learned is

that even as some business owners take the risk to open a new restaurant, that doesn’t negate the struggle that others are having just to stay open. For example,

some of our members are discussing new business models that may mean moving from full-service to counter-service