Only 20% of hotels have received any debt relief from Wall Street CMBS lenders. More than 100 Members of Congress sent bipartisan letters to the Treasury and Federal Reserve urging for help.

Thousands of Employees May Permanently Lose Their Jobs Due To a Lack of Debt Relief

American Hotel and Lodging Association President and CEO Chip Rogers:

“With a sharp decline in travel demand, nine times worse than September 11 and with lower room occupancy than during the Great Depression, our small business owners are struggling to survive. The human toll on our industry has been equally as devastating. Right now, many hotels are struggling to service their debt and keep their lights on, especially those with Commercial Mortgage-Backed Securities (CMBS) loans as they have been unable to obtain urgently-needed debt relief. Without action to shore up commercial debt, especially CMBS loans, the hotel industry will experience mass foreclosures and permanent job losses which will snowball into a larger commercial real estate crisis impacting other segments of the economy.”

Wall Street Journal:

Hotel Owner Seeking Mortgage Relief? Not If Wall Street Owns Your Loan – “The coronavirus shutdown has spared few companies in the travel business, but times are especially tough for hotel owners whose mortgages are owned by Wall Street investors. When they need relief, these borrowers go to so-called special servicers that negotiate on behalf of bondholders. Hotel owners seeking a break on their monthly payments say they haven’t had much success negotiating with these firms, which have an obligation to recover as much money as possible for investors. Just 20% of hotel owners whose loans had been packaged and sold to investors have been able to adjust payments in some form during the pandemic, versus 91% of hotel owners who borrowed from banks, according to a survey by the American Hotel and Lodging Association.” (The Wall Street Journal, 6/4/20)

Associated Press:

Wall Street-Owned Loans Tricky For Hoteliers In Virus Era – Commercial mortgage-backed securities loans like the one Gaekwad has for the Holiday Inn are packaged in a trust. Investors then purchase bonds from the trust using properties like a hotel as collateral. The loans are attractive to borrowers because they typically offer lower rates and longer terms. About 20% of hotels across the U.S. use these loans and they represent close to a third of all debt in the hotel industry, according to the American Hotel and Lodging Association… Unlike banks, which have been more flexible in renegotiating loan terms to help them through the tough times, hotel owners like Gaekwad say it has been much more difficult to get any forbearance from representatives of bondholders, and they worry that their businesses may not survive because of the lack of relief. (Associated Press, 6/25/20)

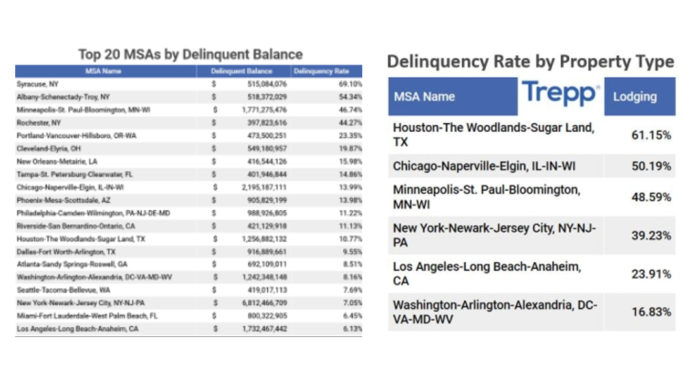

The last few months have been met with an unprecedented rise in delinquencies in the CMBS market. Like the broader market, the majority of the delinquent balance for these MSAs is on account of the delinquent loans in the lodging and retail sectors. (TREPP, 6/25/20)

A Bipartisan Group of 100+ Members of Congress Ask Treasury and Fed for Urgent Help

Wall Street Journal:

Lawmakers Ask Fed To Help Businesses Struggling To Make Mortgage Payments – More than 100 members of Congress are calling on the Trump administration and the Federal Reserve to help struggling businesses pause debt payments in a key real-estate financing market. Many of the hotels, shopping malls, and office buildings that borrow money in the roughly $550 billion market for commercial-mortgage-backed securities said they have been unable to negotiate debt reprieves during the coronavirus pandemic. Some are worried they could lose their properties to foreclosure. The Wall Street Journal reported this month. The troubles stand in contrast to other types of debt such as home mortgages, where borrowers have been able to pause payments for as much as a year as part of the more than $2 trillion stimulus package signed in March. (The Wall Street Journal, 6/23/20)

Bipartisan Congressional Letter to Treasury & Federal Reserve:

Without debt relief, U.S. facing a historic wave of foreclosures, job loss and a significant reduction in state and local tax revenue – “Without a long-term relief plan in the face of an elongated crisis, CMBS borrowers could face a historic wave of foreclosures starting this fall, impacting local communities and destroying jobs for Americans across the country. Further, surrounding property values and state and local tax revenues will plummet, worsening the recession, and removing critical revenue from local communities…We request the Department of the Treasury and the Federal Reserve urgently consider targeted economic support to bridge the temporary liquidity deficiencies facing commercial real estate borrowers created by this unforeseen crisis.” (Congressional letter to Federal Reserve and Treasury, 6/22/20)

U.S. Congressman Van Taylor (R-Texas):

“Millions of jobs depend on keeping these properties open. For example, 8.3 million jobs throughout the United States and more than 600,000 in Texas are supported by the hotel industry alone. These industries don’t need a bailout, but they do need flexibility and support to keep their doors open, provide millions of jobs in communities across the country, and drive their local economies.” (Press release, 6/23/20)

Us. Rep. Denny Heck (D-WA):

“Nearly half of commercial rents were not paid last month, and many businesses will not be able to pay their rent for the foreseeable future. History shows us this will likely result in a wave of foreclosures, massive layoffs, and less revenue to already cash-strapped state and local governments. We must do everything we can to protect the broader economy from this devastating chain reaction.” (Press release, 6/23/20)

U.S. Rep. Al Lawson (D-FL):

“COVID-19 is causing many of our industries to experience major financial hits, and the commercial real estate is no exception. Without immediate action from our financial institutions, we may see unrecoverable losses to these businesses. We are asking Secretary Mnuchin and Chairman Powell to take necessary measures to ensure this industry has the capability to survive this global pandemic.” (Press release, 6/23/20)

Changes to Main Street Lending Facility are Needed to Avoid a Commercial Real Estate Crisis

Last week, the American Hotel & Lodging Association (AHLA), Asian American Hotel Association (AAHOA) Latino Hotel Association (LHA), National Association of Black Hotel Owners and Developers (NABHOOD) called on the Treasury and Fed adjust the creditworthiness evaluation requirements for the Main Street Lending Facility to ensure that hotels, and other asset-based borrowers, are able to utilize this vital liquidity to keep people employed and survive the COVID-19 crisis.